The California Supreme Court selected vertical exhaustion of policy limits as the rule in determining the sequence by which a policyholder may access excess general liability insurance coverage in its April 6, 2020 decision in Montrose Chemical Corporation of California v. Superior Court of Los Angeles County. In doing so, it rejected horizontal exhaustion as the rule in multi-tiered excess policy allocation cases.

MONTROSE CASE BACKGROUND

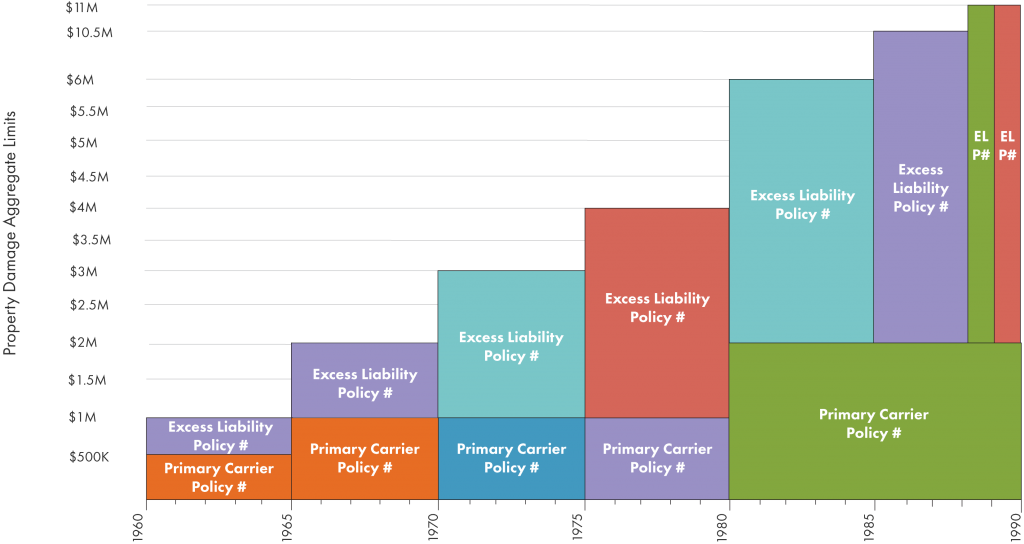

The Montrose Chemical Corporation (Montrose) saga began in 1990. The company filed a lawsuit to resolve various coverage disputes relating to claims it had tendered to its general liability insurers concerning continuous environmental property damage at its Los Angeles plant. Over the years, Montrose prevailed, and these carriers provided coverage under the primary insurance policies they issued in policy periods spanning 1947 to 1982.

A new chapter in the story, however, was opened in 2015 when Montrose filed its fifth amended complaint, seeking a declaration that its excess general liability insurers indemnify it for pollution clean-up costs under a theory of vertical exhaustion or elective stacking. It was now Montrose’s assertion that coverage under each excess policy was triggered as soon as the limits of an excess policy below it and within the same policy period had been exhausted.

In response, Montrose’s excess insurers argued collectively that Montrose’s upper tier excess policies would only be triggered when alllower level excess insurance policies covering the relevant years had been exhausted. The trial court denied Montrose’s motion for declaratory judgment and granted the insurers’ motion, ruling that the excess policies required horizontal exhaustion.

Montrose’s petition to the Appellate Court was denied. However, in 2017, unexpected aid from another Appellate Court arrived in the form of a published opinion in a case styled State of California v. Continental Insurance Co., 15 Cal. App. 5th 1017. The court in that case determined that vertical exhaustion, not horizontal exhaustion was the appropriate rule given the same policy language and California legal precedents.

MONTROSE V. SUPERIOR COURT OF LOS ANGELES COUNTY CASE

The California Supreme Court granted review in this case to determine “whether vertical exhaustion or horizontal exhaustion is required when continuous injury occurs over the course of multiple policy periods for which an insured purchased multiple layers of excess insurance”. Reading the relevant policy language “in light of background principles of insurance law and considering the parties reasonable expectations”, the Supreme Court concluded that “a rule of vertical exhaustion is appropriate”. Under that rule, the insured has access to any excess policy once it has exhausted other directly underlying excess policies with lower attachment points. Additionally, it ruled that an insurer called on to provide indemnification may, however, seek reimbursement from other insurers that would have been liable to provide coverage under any excess policies issued for any period in which the injury occurred.

CASE INSIGHTS

An important consideration in the Supreme Court’s decision was the meaning of the other insurance clauses in the excess policies central to both the Montrose and Continental Insurance Co. appellate cases. Because nothing in these other insurance clauses “clearly or explicitly” stated that all lower-tier excess policies purchased at different policy periods must first all be exhausted, the Supreme Court was unwilling to give them such an interpretation. The Court found that the policies “are most naturally read to mean” that Montrose “may access its excess insurance whenever it has exhausted the other directly underlying excess insurance policies that were purchased for the same policy period.”

The California Supreme Court’s decision gives policyholders significant flexibility in pursing insurance recoveries in long-term injury cases such as environmental, cleanup, construction defect and toxic tort.

If you are dealing with environmental liability or latent injury, contact us for a confidential consultation.

David O’Neill, JD, Director of Investigations

David has over 20 years of experience in claims recovery on behalf of corporate policyholders involving environmental property damage, toxic tort, and asbestos exposure claims. O’Neill has worked on over 700 projects including the reconstruction of insurance coverage for the countrywide rollup of the nation’s largest waste disposal company.