LAW ELIMINATES STATUTE OF LIMITATIONS ON SEXUAL ASSAULT FOR ONE YEAR

BY: KRISTEN DRAKE

On May 24, 2022, New York Governor, Kathy Hochul, signed the Adult Survivors Act (ASA) into law. The ASA creates a one-year ‘Lookback Window’ which opens on November 24, 2022, to allow survivors who were adults (18 and older) at the time they were sexually abused and assaulted to sue their abusers – regardless of when the offenses occurred.

In 2019, the state of New York enacted the Child Victims Act (CVA) which opened a ‘Lookback Window’ to commence civil actions. The CVA was extended another year due to the COVID-19 pandemic, and when the window closed in August of 2021, nearly 11,000 lawsuits had been filed. During the CVA lookback window, countless churches, schools, foster care agencies, and youth-based organizations were obliged to respond to the alleged abuses. An important differentiation between the CVA and the ASA, is the age of the survivor when the sexual abuse or assault occurred, although both fall under the broader category of reviver statutes. Prior to the ASA, reviver statutes focused primarily on abuses against children. With this new law, it’s likely that different types of organizations will face allegations dating back decades, because the survivors were 18 and older when the sexual assault or abuses happened. This expansion may include accusations made regarding assaults at colleges, in the workplace, and/or health care facility abuses – to name a few.

DECADES-OLD OCCURRENCE-BASED GENERAL LIABILITY POLICIES CAN HELP

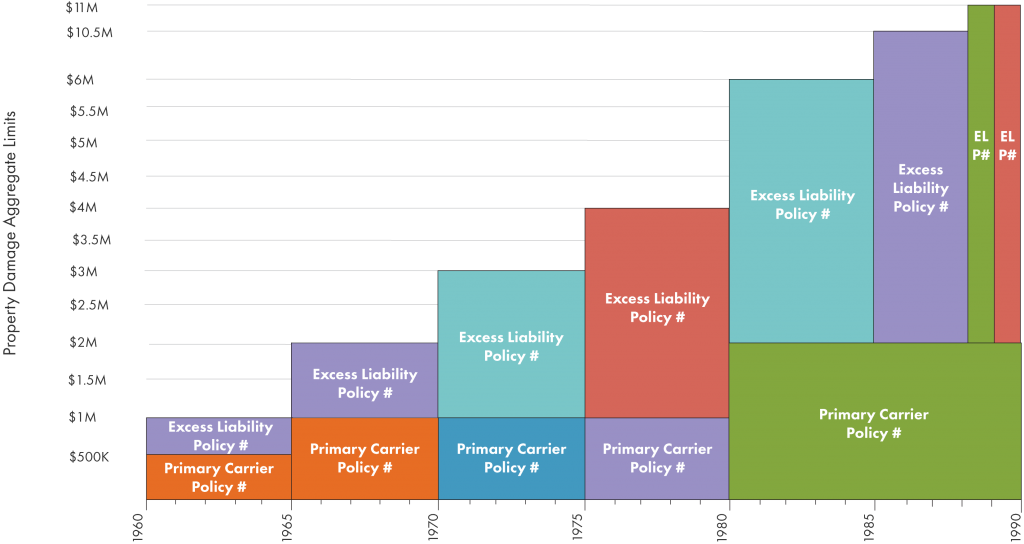

When states enact these lookback windows, removing or reducing the statute of limitations for sexual abuse civil suits, organizations that were proximal to alleged abuses can get caught in the crossfire between plaintiffs and alleged offenders. Occurrence-based Commercial General Liability (CGL) policies issued during the policy periods in which the alleged abuse occurred can respond to these new claims – even if the alleged abuse happened in the 1960s.

DEFENDANT ORGANIZATIONS SHOULD CONSIDER INSURANCE ARCHEOLOGY

As more organizations are compelled to identify and locate their decades-old liability policies to help pay damages, they are oftentimes disheartened to learn how difficult it can be. Since the time of interest in reviver statute claims is oftentimes at least 40 years ago, many records could be lost, destroyed by fire or flood, or purposely purged.

Upon receiving notice that a lawsuit has been filed against them under a reviver statute, defendant organizations should contact their attorneys, who typically suggest contact with their current insurance agents and brokers. Because of standard document retention practices, these companies quickly learn their current agent/broker has no information dating back decades. It’s at this point or perhaps following a fruitless internal archive search, that defendant organizations should consider Insurance Archeology.

Insurance Archeology is the practice of locating and retrieving proof of the existence, terms, conditions, and limits of lost or destroyed insurance policies. PolicyFind’s expertise is finding and bringing to light old insurance coverage for our clients. Under current and future reviver statutes across the country, historical CGL policies issued to businesses, schools, churches, and other organizations, are the first line of assets to be explored to pay for claims against them.

Contact PolicyFind today to learn more about your organization’s historical liability insurance portfolio.

Kristen Drake brings more than a decade of research and managerial experience in broadcast journalism to the field of insurance archeology. Since joining the PolicyFind team in 2015, Mrs. Drake has successfully documented liability insurance programs on behalf of municipalities, manufacturers and dry cleaners. She continues to translate her expertise in source procurement and digital fact-finding, performing insurance research activities at a very high level, providing on-time execution of contracted performance goals.

Kristen Drake brings more than a decade of research and managerial experience in broadcast journalism to the field of insurance archeology. Since joining the PolicyFind team in 2015, Mrs. Drake has successfully documented liability insurance programs on behalf of municipalities, manufacturers and dry cleaners. She continues to translate her expertise in source procurement and digital fact-finding, performing insurance research activities at a very high level, providing on-time execution of contracted performance goals.