BY: KRISTEN DRAKE

On May 20, 2025, PolicyFind had the opportunity to speak at the Perrin Conferences’ Talc Litigation Conference, where we joined esteemed colleagues on the Insurance & Risk Management Panel. The discussions were insightful, covering the evolving landscape of talc litigation, risk mitigation strategies, and the complexities of insurance coverage.

Understanding the Legal Landscape

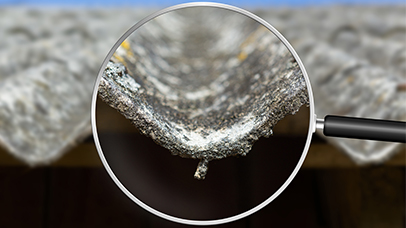

Talc litigation has been a growing concern for businesses, manufacturers, and insurers alike. With claims linking talc-based products to health risks, the legal environment has become increasingly complex. As a newly named defendant, the first step is to understand the scope of the allegations and the legal precedents shaping these cases.

Immediate Steps to Take

Being named in litigation can be overwhelming, but taking proactive steps can help navigate the process effectively:

- Consult Legal Counsel – Engaging experienced attorneys specializing in talc litigation is crucial.

- Review Insurance Coverage – Understanding policy terms and potential coverage for defense costs is essential.

- Gather Documentation – Collecting relevant records, product testing data, and compliance history can support your defense.

- Engage an Insurance Archaeology Firm – Identifying historical policies to determine potential insurance recovery is key.

- Assess Risk Management Strategies – Evaluating exposure and implementing mitigation measures can help protect your business.

The Role of Key Players in Talc Litigation

Successfully navigating talc litigation requires a coordinated effort among legal counsel, insurance archaeologists, and insurers. Each plays a distinct yet interdependent role in building a strong defense, identifying potential coverage, and managing financial exposure. Understanding how these players collaborate from the outset can make a significant difference in the outcome of a case.

Legal Counsel: Getting It Right from the Start

New defendants entering talc litigation must navigate unfamiliar terrain. The role of legal counsel is pivotal in setting a strong foundation for defense strategy. Some essential aspects include:

- Preparing the Client – Educating clients on what to expect throughout the litigation process.

- Initial Information Gathering – Collecting corporate documents, product history, and compliance records.

- Differentiating Talc from Asbestos Litigation – Recognizing unique aspects that distinguish talc cases from traditional asbestos cases, including plaintiff demographics and scientific evidence.

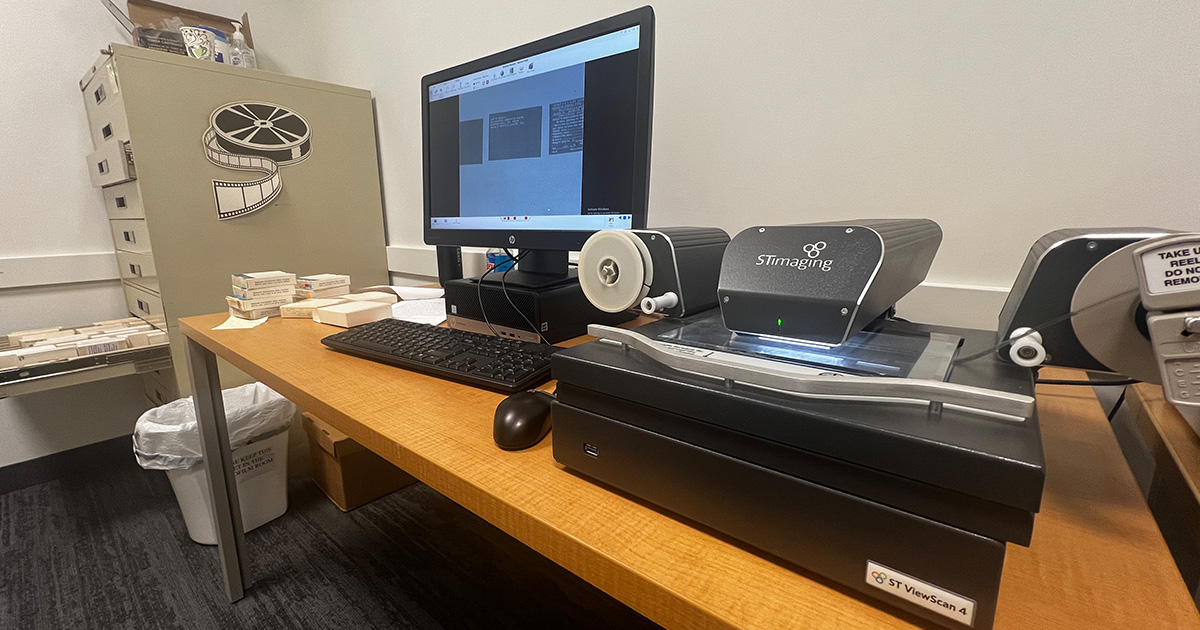

Insurance Archaeology: Identifying Coverage

Insurance archaeologists work closely with defendants and counsel to uncover historical policies that may provide financial coverage for litigation.

- Understanding Corporate Transactions – Throughout time, many talc-related companies have experienced numerous mergers and acquisitions, complicating coverage retrieval.

- Historical Policy Discovery – Identifying policies that may respond to defense and indemnity costs.

- Challenges in Coverage – Dealing with policy gaps, exclusions, and insurer responses.

The Role of Insurers

Insurance carriers play a crucial role in talc litigation, assessing the scope of coverage and evaluating potential exposure. Key considerations include:

- When a Case First Crosses the Desk – Evaluating claims early to determine defense strategies.

- Lessons Learned from Traditional Asbestos Cases – Applying past litigation experiences to talc claims.

- Understanding Coverage Limits – Assessing the extent of liability coverage under historical and current policies.

Lessons at the Talc Litigation Conference

The insights shared at Perrin Conferences’ Talc Litigation Conference provided valuable perspectives on litigation trends, defense strategies, and insurance considerations. One key takeaway was the importance of early case assessment, which involves understanding the claims, evaluating potential liability, identifying historical insurance coverage, and developing a robust defense strategy.

Moving Forward

While being named in talc litigation is undoubtedly challenging, it also presents an opportunity to strengthen compliance efforts, enhance risk management strategies, and contribute to industry discussions on best practices. Staying informed, collaborating with legal and insurance experts, and leveraging industry insights can help navigate this complex terrain.

Whether you’re a newly named defendant or an industry professional seeking to stay ahead, continuous learning and strategic planning are key to managing talc litigation effectively.

Why PolicyFind

Talc litigation poses significant financial risks, and finding historical coverage can help companies recover defense and indemnity costs, potentially saving millions.

PolicyFind’s expertise is unparalleled in conducting corporate history reconstruction and locating evidence of historical insurance coverage. We work directly with policyholders, insurance carriers seeking to discover coverage for cost-sharing, and attorneys involved in multi-pronged legal strategies to locate and recover lost or mislaid policies.

Over our 20+ year history, PolicyFind has amassed an unparalleled success rate in finding evidence of applicable historical coverage and is widely regarded as an industry leader. Our team comprises professional investigators, insurance analysts, and industry experts with extensive experience in locating and interpreting insurance policies.

Contact PolicyFind today to learn more about how to discover and reconstruct your organization’s historical liability insurance portfolio.