BY: KRISTEN DRAKE

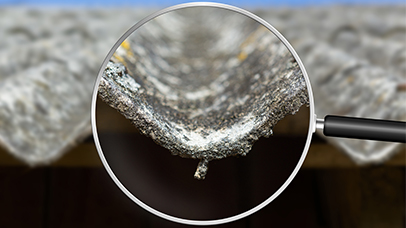

For decades, PolicyFind has specialized in working with companies facing multimillion-dollar lawsuits alleging serious injury or death associated with asbestos exposure. These claims can devastate businesses financially and leave them with few options apart from trying to get cases dismissed or settling out of court. While the latter can yield the best outcome for both parties in one case, it is possible, perhaps probable, that one asbestos exposure case may open the floodgates for multiple suits to be filed.

Our clients routinely share that they are unsure why they have been named in a lawsuit because they have no known connection to asbestos-related products. Even so, many of our clients report being named in multiple cases after being named in their first. According to the U.S. Chamber of Commerce Institute for Legal Reform, the reason for numerous lawsuits may be partially linked to ‘over-naming.’ “Over-naming is especially common in asbestos lawsuits. As litigation drove the manufacturers of the most common and most dangerous asbestos-containing products, like insulation, into bankruptcy, lawyers began to target other less-involved companies in new lawsuits. As the number of potential targets grew, some began filing “boilerplate” complaints that included dozens—sometimes one hundred or more—defendants without thoroughly researching which companies may actually be involved in a specific case.”

For these reasons, PolicyFind works alongside construction, automotive, manufacturing, power generation, and shipbuilding companies and their attorneys every day to locate and quantify their historical liability insurance policies. Once successfully identified, these occurrence-based policies provide a valuable funding source to answer asbestos exposure demands.

WHAT IS INSURANCE ARCHAEOLOGY?

Historical CGL policies are found through insurance archaeology, the process of locating, reconstructing, and evaluating historical insurance. Insurance archaeology retraces the genealogy of insurance coverage over a company’s life. The retroactive nature of long-tail claims, like asbestos, can defend against damage or injury that is not evident until years later.

Furthermore, historical insurance policies never die. The historical insurance policies of bankrupt and defunct companies can defend current claims, and the same is true for the historical insurance policies of deceased individuals.

WHY POLICYFIND

Asbestos litigation poses significant financial risks, and finding historical coverage can help companies recover defense and indemnity costs, potentially saving millions.

PolicyFind’s expertise is unparalleled in conducting corporate history reconstruction and locating evidence of historical insurance coverage. We work directly with policyholders, insurance carriers seeking to discover coverage for cost-sharing, and attorneys involved in multi-pronged legal strategies to locate and recover lost or mislaid policies.

Over our 20+ year history, PolicyFind has amassed an unparalleled success rate in finding evidence of applicable historical coverage and is widely regarded as an industry leader. Our team includes professional investigators, insurance analysts, and industry experts with years of dedicated experience locating and interpreting insurance policies.

Contact PolicyFind today to learn more about how to discover and reconstruct your organization’s historical liability insurance portfolio.