Did you know that historical commercial general liability (CGL) insurance policies are valuable assets that can be worth millions of dollars in the form of paying for legal fees, settlements, and damages? Historical insurance assets can protect the policyholder from lawsuits and administrative orders, and in many cases, can be worth cash.

“When old insurance policies are brought to the light of day, they put small business owners on the same playing field as governments and companies with deep resources.”

– Brent Huber, Ice Miller, LLP

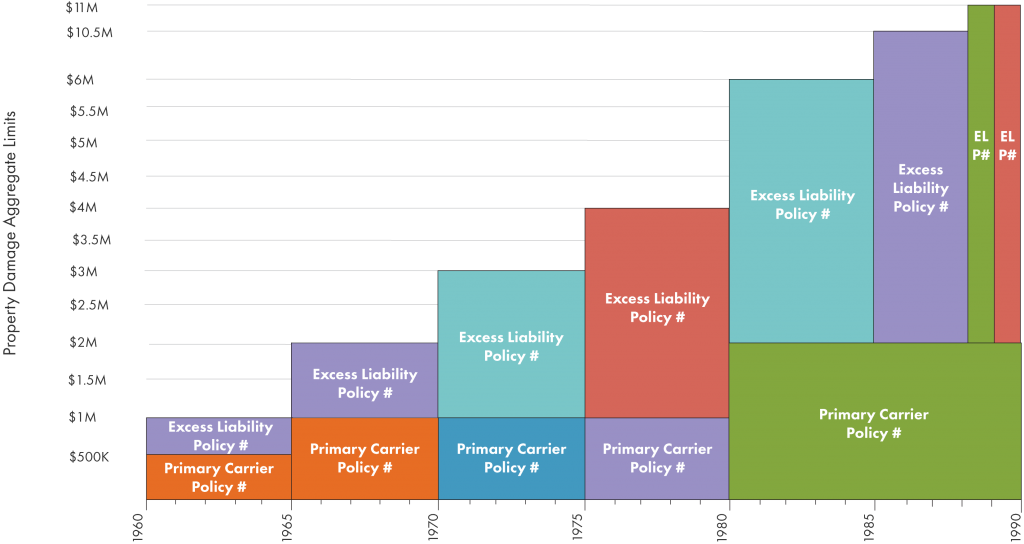

The retrieval or reconstruction of a lost or misplaced CGL insurance policy can protect institutions from serious financial loss. A single insurance archaeology project can provide millions of dollars in defense costs and indemnity to the institutions faced with response costs for injuries and damages occurring under previous management. By using a company’s historical CGL insurance policies as a funding source to pay for the expensive cost of long-tail liabilities, important projects like asbestos abatement and environmental remediation can successfully move forward.

WHAT ARE COMMERCIAL GENERAL LIABILITY INSURANCE POLICIES?

CGL insurance policies are purchased by business owners to cover them against their business’ liability exposures. This is very important in determining whether an individual or business’ old insurance policies can be used to pay for environmental investigations and remediation.

This makes CGL policies very important protection for corporate policyholders because they broadly provide defense and indemnity coverage against claims for bodily injury and property damage. Coverage includes products, completed operations, premises and operations, elevators, and independent contractors, to name a few.

HOW DO COMMERICAL GENERAL LIABILITY POLICIES PROVIDE LONG-TAIL CLAIMS COVERAGE?

Historical CGL insurance policies can be leveraged in legal defense and in cost-sharing of defense and settlements. The retroactive nature of long-tail environmental claims and latent injury claims, like asbestos exposure, means that old policies can be used to resolve complex claims involving events that occurred decades ago. These liabilities may be covered under old insurance policies which tend to be less restrictive and provide broader coverage. Even policies of bankrupt and defunct companies are commonly used to defend current claims. The same is true for the old policies of deceased individuals.

The resurrection of policies provides proof of coverage and equitable allocations which benefits both policyholders and insurance carriers. Insurance archeologists skillfully search and retrieve historical information that determines the coverage for claims and defense fees. The rebuilding of historical insurance coverage can limit the liability of individual clients and their carriers, and initiate coverage from additional policies, thereby creating a larger reservoir of monies for equitable allocation.

USING YOUR POLICIES FOR DEFENSE AND INDEMNIFICATION

After finding the old CGL policies, it is then critical that you know how to use these policies to your benefit. Insurance law is different from state to state and not every state has good law for the policyholder. Insurance policies contain different language, terms, and conditions which can vary by carrier and by policy period.

In pulling this concept together:

- A defense includes paying for lawyers dealing with latent injury cases including asbestos exposure, bodily injury and abuse claims. A defense would also include quantifying an individual or business’s exposure and liability.

- Indemnification is the process where the insurer makes the insured ‘whole’ again by paying for damages or losses already sustained and expenses already incurred.

WHO CAN BENEFIT FROM HISTORICAL COMMERCIAL GENERAL LIABILITY POLICIES?

Historical insurance policies can be beneficial in providing coverage for a number of different situations. For example:

- Plumbing and building supply companies defending product liability claims from exposure to products sold containing asbestos.

- Municipalities involved in litigation.

- Manufacturers of pumps defending product liability claims from exposure to asbestos gaskets.

- Churches and schools defending personal injury claims.

- Business property owners defending property damage claims by state environmental authorities.

- Insurance companies defending policyholders against environmental property damage claims and wishing to document insurance coverage of other potentially responsible parties.

WHAT DO HISTORICAL COMMERICAL GENERAL LIABILITY POLICIES COVER?

Once triggered, historical CGL policies may be used to for legal fees, defense against legal claims, interfacing with agencies, policy buyback, potentially responsible party (PRP) search, recouping costs, build legal cases, interim remedial measures, remediation/cleanup, site investigation and prior costs be may be retroactively recovered.

There could be millions of dollars in unclaimed assets available to parties looking to defend environmental claims and personal injury claims. PolicyFind works diligently every day to find yesterday’s policies for today’s claims.

HOW DO YOU FIND HISTORICAL CGL POLICIES?

Contact an insurance archeology firm with a multiline approach to developing leads to historical insurance assets and a large specimen policy library. An insurance archeology firm will locate your old policies to help you find the funds to defend against contamination, latent injury, asbestos, and toxic tort.

Call PolicyFind’s insurance archeology experts today at 866-888-7911 or fill out our form.

Kristen Drake, Director of Operations

Kristen combines her profession as an insurance archeologist with over 10 years as an investigative journalist to reconstruct historical insurance coverage for clients. She has successfully located evidence of liability insurance coverage on over 250 projects. Kristen works on behalf of policyholders defending against environmental toxic tort and asbestos exposure, carriers seeking cost allocation, and plaintiffs and defense attorneys representing clients within asbestos claims.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]